By now, you should know that estate planning means more than just getting a will. Yes, there is the actual “planning” part in estate planning that requires pulling together details about your circumstances and creating a customized plan. However, there are some key documents you should have in your estate plan so that it can function without any hitch.

Hence, you will agree with me that you need the services of a professional lawyer to execute your real estate planning efficiently. To be on the safe side, we recommend you work with the Law Office of R. Grace Rodriguez. Our lawyers offer comprehensive services and work diligently with you to make your estate planning an easy one.

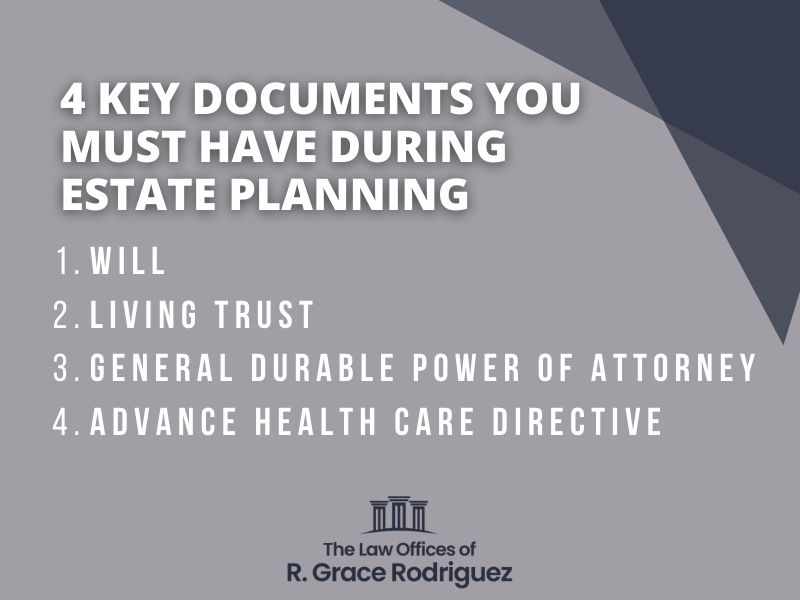

Meanwhile, this article will enlighten you on the best ways to achieve estate planning in California. We will also be discussing the 4 key documents you must have during estate planning. Let’s explore more.

1) Will

A will is the first thing that comes to mind when someone hears about estate planning. A will is a comprehensive, legal document you can use to direct how your property will be divided when you die.

If you die and you don’t have a will in place, your property will be divided according to California’s rules of intestate succession. Most likely, the way they will share your property would be different from how you would want your property to be shared.

This is another big reason to walk into the Law Office of R. Grace Rodriguez for your will. We are a heart-centered practice. This means we are compassionate, understanding, and patient as we guide you through the legal process. Our goal is to provide you the best legal services and a solution to any legal problem you might be facing.

However, a will must be admitted to probate for it to be effective. Probate in California is an expensive, lengthy process. The majority of Californians prefer to avoid it entirely. They prefer to combine the will with another estate planning document called a living trust. Of course, it is a good idea.

2) Living Trust

A living trust is a legal arrangement whereby the trustee owns property on behalf of the named beneficiaries. The person who creates the first trust is known as the initial trustee. The goal of the trust agreement is to specify how the property is to be divided when you die and who should take over as trustee.

The benefit of a living trust is that you don’t have to go to court to get things done. You can think of it as a simplified, private probate process. A living trust is formally referred to as a “revocable trust.” This is because it can be changed and completely revoked at any time. That is, you can avoid a lengthy probate administration without losing control over your property while you’re still alive.

3) General Durable Power of Attorney

A general power of attorney is a document that grants someone else authority over your possessions and monetary dealings. What makes a durable power of attorney special is that it is effective because you said it should. This means you still have the power to control whoever is in charge of your property and financial transactions.

You must have a general durable power of attorney in place so that decisions can be made on your behalf if you become incapacitated. However, you should think carefully about who you want to appoint to make those decisions since you won’t be available to oversee their actions.

4) Advance Health Care Directive

The California Legislature has enacted a statutory advance healthcare directive form. This allows you to appoint someone under a power of attorney for healthcare and give specific directions about your care.

Part 1 of the statutory form is a power of attorney for health care. It grants authority over medical decisions and not financial decisions. This document is powerful. You should read the instructions carefully and speak with an attorney about it before appointing someone to exercise that power.

Part 2 of the statutory form allows you to give specific instructions for healthcare that the doctor and the person appointed for part 1 must follow.

Parts 3 and 4 allow you to choose if you want to donate your organ when you die. Completing an advanced health care directive helps to tell your doctor who to look to for your health decisions when you are unable to make them.

Wrapping Up

Having the 4 key documents described above is vital to your estate plan. However, if you don’t have any or all of the major components of the California estate plan, feel free to reach out to us at The Law Office of R. Grace Rodriguez. We are dedicated to providing quality legal services at an affordable price.