As the past several years have shown, life can be unexpected. Having a strong yet adaptable plan for your future is essential to ensuring that your family and children are cared for in the event that a life-changing event occurs.

Even if you have a Last Will & Testament document or a previously established estate plan in place, there can be many times that you will need to address changes or updates. With the help of a trained and experienced estate planning lawyer, you can stay ahead of the changes in your estate plan and ensure that your final wishes stay on track.

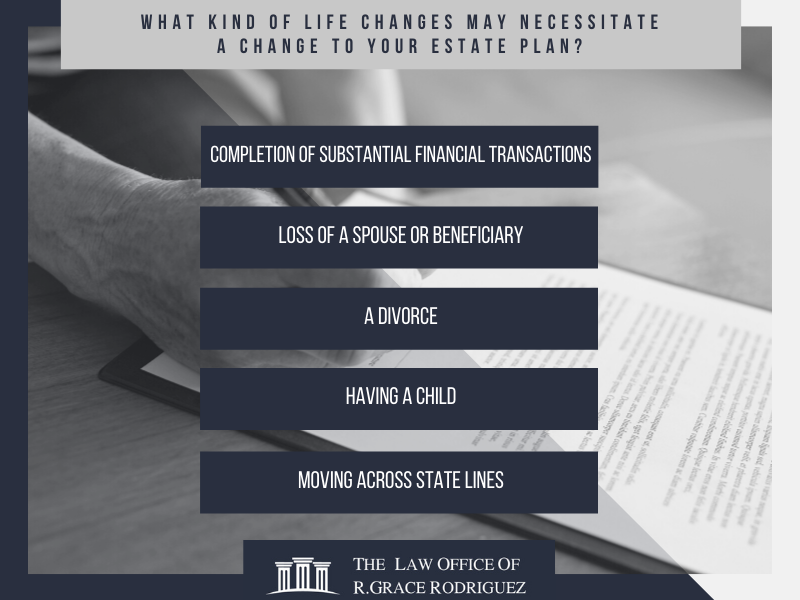

What kind of life changes may necessitate a change to your estate plan? Let’s take a look at the most common changes that may require updates:

Loss of a Spouse or Beneficiary

You aren’t the only individual involved in your estate plan. In the event that your spouse or other beneficiary passes away or becomes incapacitated, it may be necessary for you to update your estate plan or trust documents to switch individuals.

A Divorce

Similarly to a death, if you and your spouse undergo a divorce, it is likely that you will want to update your estate plan documentation to remove them from your will. If they were listed as a beneficiary, it may be necessary to remove them from that role as well – especially if they are listed as a Power of Attorney

Having A Child

As you may imagine, the event of having a child brings with it many updates to your life. This includes your estate plan. Make sure that your new child has been added to your estate plan and other trust documents to ensure that they are included in the process.

Completion Of Substantial Financial Transactions

Anytime that you complete a major transaction with your finances – such as adding assets, stock, real estate to your portfolio – it is important to update your estate plan to reflect the added items. The same is true in the event that you remove assets or sell a business. An updated plan will reflect the most accurate information and save you or your family time and cost in the future.

Moving Across State Lines

If you are moving from one state to another, it may be necessary to update your estate plan to reflect accurate information and meet the requirements of your particular state. While many states will honor the estate plans from another location, it is still vital to meet with an attorney to understand any changes or updates that may be necessary after your move

Don’t Risk The Complications of Probate

In nearly every state of the United States of America, the probate process is filled with expensive and complicated fine details. As every case is unique and requires quite a bit of work to properly execute, having your estate plan up to date and accurate can save your family members time and money in the event of your passing or becoming incapacitated.

Don’t leave your estate plan and will have a chance. Meet with an expert attorney today to begin the process of understanding what steps must be taken to ensure that your estate plan is updated and ready for the unexpected.

At the Law Office Of R. Grace Rodriguez, an experienced estate planning attorney will work with you to ensure that your estate plan is up to date, and that you are aware of any needed changes that may be necessary as you look toward the future. Contact our team today to learn more and to set up an appointment!