Loans and bankruptcy are a challenging subject. What kind of bankruptcy applies to your circumstance? Understanding how loans and bankruptcy work, both separately and in tandem, is the first step in figuring that out.

Loans

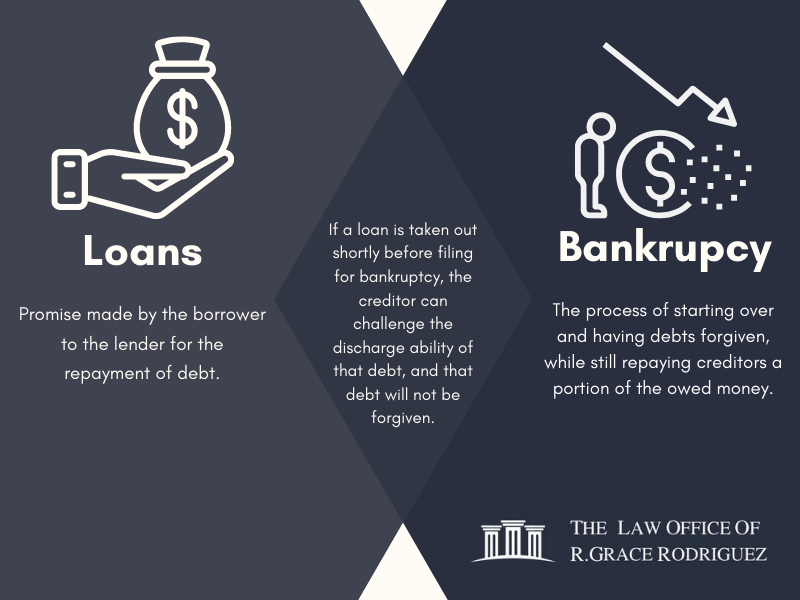

A loan is a promise made by the borrower to the lender for the repayment of debt. The amount of funds a lender is willing to loan depends heavily upon the credit score of the borrower. A good credit score may also result in lower interest rates.

The interest rate for any given loan can vary. Fixed interest rates stay the same, whereas variable interest rates change with the market. Some interest rates are simple and remain the same until they are paid off. Others are compound, and the interest rate grows more the less you pay for each pay period.

The most critical thing to understand is that each time a pay period comes around, the interest must be paid. However, if a surplus is paid, that extra payment goes toward the initial loan amount. In other words, the more the money paid for each pay period, the less interest grows, and the quicker the loan is paid back.

Bankruptcy

Bankruptcy is the process of starting over and having debts forgiven, while still repaying creditors a portion of the owed money. The process of bankruptcy helps people at every level of the economy. Debtors get a second chance at building a good credit score, and creditors are given a portion of their money back.

Bankruptcy has several causes. For example, if an individual can no longer meet their monthly credit card charges or the payments on a loan, they can file bankruptcy to gain some relief. However, bankruptcy is not a get-off-free card. The types of bankruptcy filed will have different effects on a person’s assets and situation.

If a debtor filing bankruptcy owns a property and possesses several assets, their property may be sold, and their assets liquidated to help give their creditors some compensation. However, if the individual has a business that could be salvageable, filing for bankruptcy could allow them to reorganize their debt into a payable three to five-year plan depending on their means and ability to do so. That allows the business to catch up and bounce back.

Loans and Bankruptcy

Some borrowers take out a loan right before filing for bankruptcy (or shortly afterward) to try and help with the bankruptcy costs. While this can help meet the required funds involved in a bankruptcy, it is not necessarily beneficial to the process.

Simply put, a debtor considering taking out a loan right before going bankrupt is considering borrowing money with the knowledge that they will be unable to repay it. Legally, that can get complicated fast. If a loan is taken out shortly before filing for bankruptcy, the creditor can challenge the discharge ability of that debt, and that debt will not be forgiven.

If you are facing bankruptcy and are uncertain what to do next, contact the Law Office of R. Grace Rodriguez for a free consultation. Filing for bankruptcy is a delicate process, and you need to know what is right for you.