A lot of people often ask what happens when you file a bankruptcy case. If you are going through this process, there are a few things that are most likely to happen. Once a bankruptcy case is filed, anything regarding debt collection must stop. Hence, you must have an understanding of what bankruptcy entails and the best way to go through it. That said, we will be laying emphasis on bankruptcy and the best way to go about it in this article. Let’s proceed.

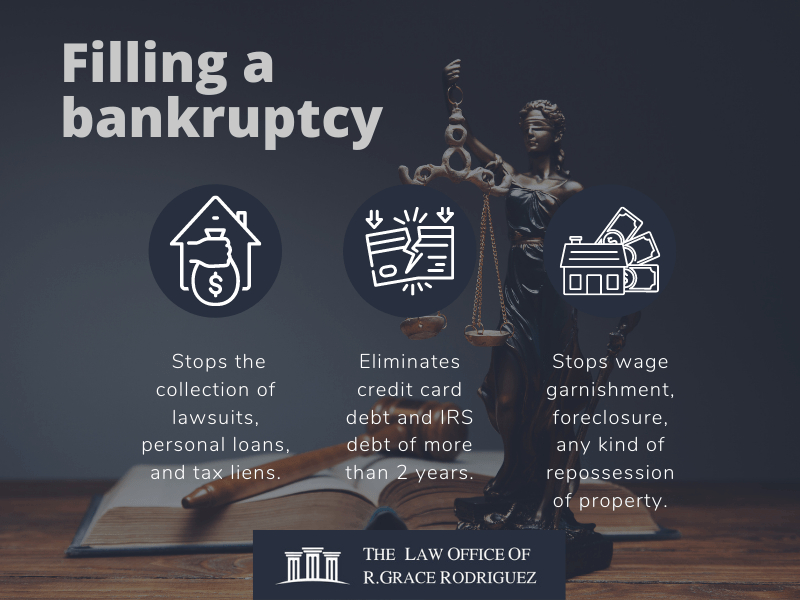

Filing Bankruptcy Does The Following:

- It stops the collection of lawsuits, personal loans, and tax liens.

- It eliminates credit card debt and IRS debt of more than 2 years. During this process, you will stop collecting lawsuits and personal loans.

- It stops wage garnishment, foreclosure, any kind of repossession of property.

How Does Declaring Bankruptcy Work?

Many people have always asked this question. However, the answer really depends on the goal and strategy for filing bankruptcy. Thus, you must equip yourself with useful information before you make a decision.

What You Need To Know Before Declaring Bankruptcy

If you declare bankruptcy, you should know if your income is higher or lower than the limit set by the court. Income limits vary according to the place of filing and size of the household. You will also be required to disclose all your assets, income, debts, and liabilities.

After you have completed all the necessary documents and filed for bankruptcy, you need to confirm if you have successfully listed all your debts, assets, and liabilities. The court will assign a trustee to you to make sure that full disclosure has occurred. The trustee is also the person that reviews a payment plan that will be easy for you to return some debts.

Best Time To Declare Bankruptcy

If you are owing heavy debts, with the stress of receiving collection calls and harassment from your creditors, it might just be the perfect time to declare bankruptcy. You should talk to a capable lawyer and discuss your situation in detail. At least see if you qualify and ask if it is possible to improve your condition by filing bankruptcy.

Filing For Bankruptcy In Los Angeles- THE WAY FORWARD

Generally speaking, when you file bankruptcy, the goal is to immediately stop all collections and eliminate debts. Although bankruptcy is not the best move for everyone. Some people have too many assets, high personal savings, or high equity. You should consider all these factors before you file for bankruptcy. For the best outcome, it is advisable that you work with an experienced bankruptcy lawyer to discuss your situation and get the best legal advice.